2025 Roth Ira Limits - 2025 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED — Day Hagan, For 2025, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined. In 2025, this increases to $7,000 or $8,000 if you're age 50+. Roth IRA Contribution Limits for 2023 and 2025 How to Maximize Tax, Roth ira income limits for 2025 brokerage products: You can make 2025 ira contributions until the.

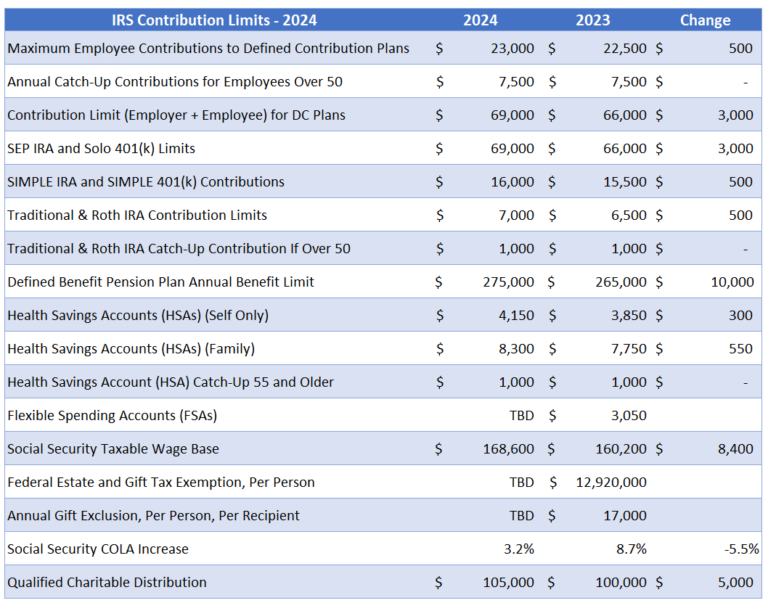

2025 RETIREMENT ACCOUNT CONTRIBUTION LIMITS ANNOUNCED — Day Hagan, For 2025, the irs only allows you to save a total of $7,000 across all your traditional and roth iras, combined. In 2025, this increases to $7,000 or $8,000 if you're age 50+.

$8,000 in individual contributions if you’re 50 or older. You’re allowed to increase that to $7,500 ($8,000 in 2025) if you’re age.

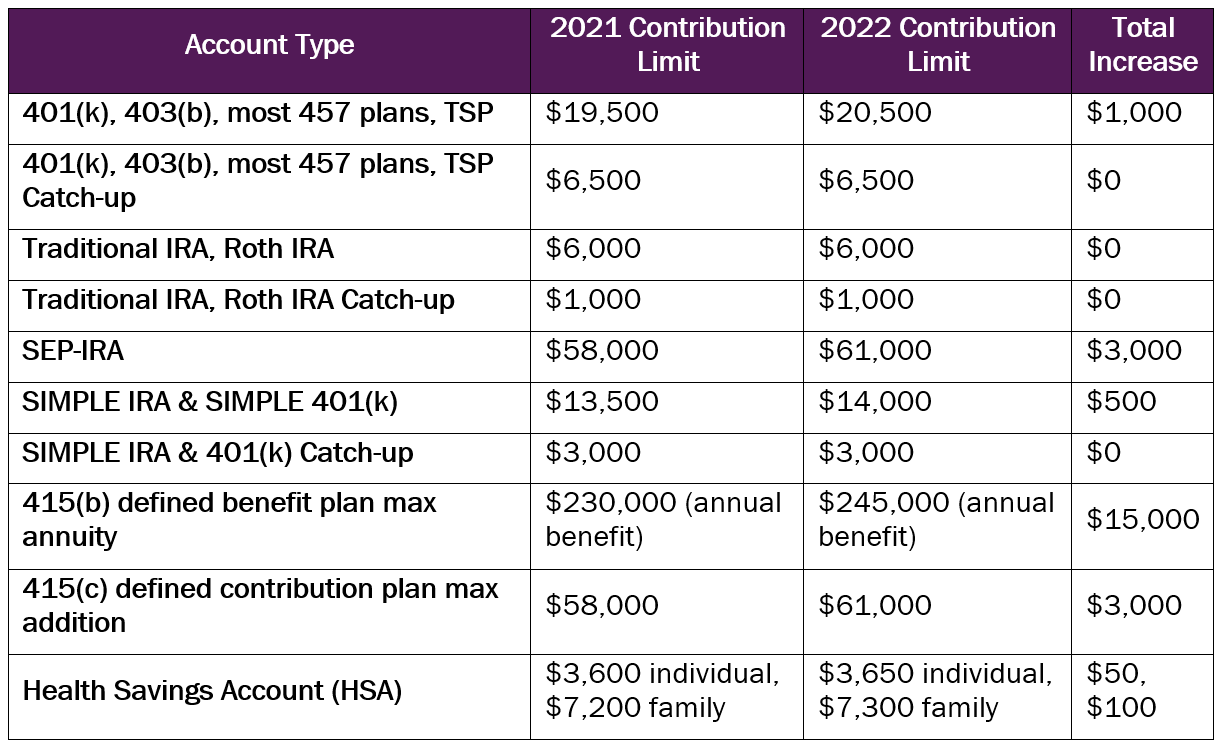

non working spouse ira contribution limits 2025 Choosing Your Gold IRA, If you are 50 or. 401 (k) limit increases to $23,000 for 2025, ira limit rises to $7,000.

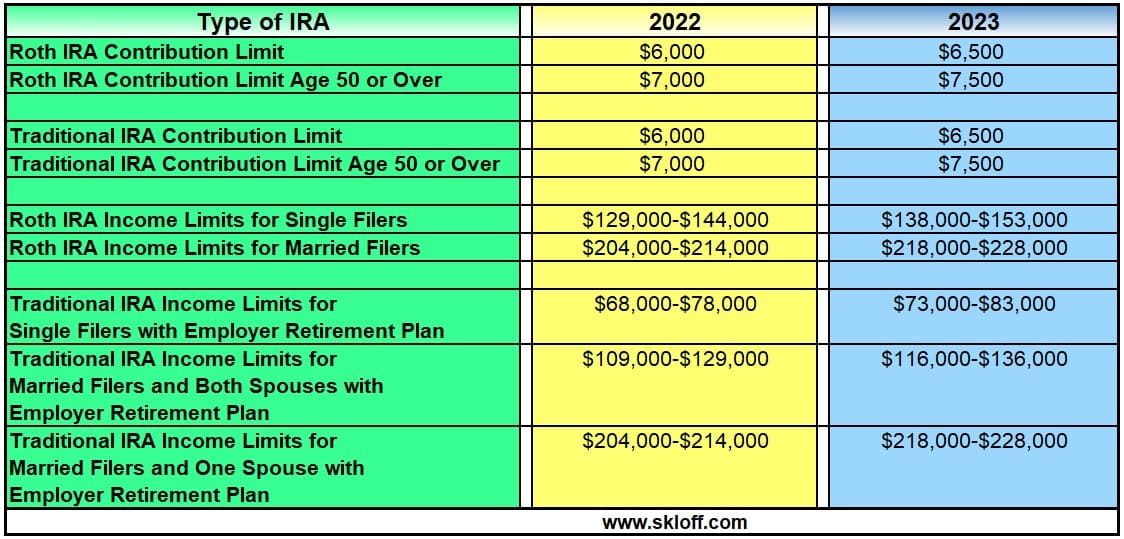

What is a Roth IRA? The Fancy Accountant, For the 2025 tax year, the limit on traditional and roth iras is $7,000 ($6,500 for tax year 2023). The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50 and older.

Roth IRA Limits 2025 Debt Free To Early Retirement, For individuals under 50, the roth ira contribution limit in 2025 is $7,000, a $500 increase from 2023. 2025 roth ira contribution limits.

The roth individual retirement account (roth ira) has a contribution limit, which is $7,000 in 2025—or $8,000 if you are 50 or older.

What Are the IRA Contribution and Limits for 2025 and 2023? 02, If you are 50 or older by the end of 2025, you may contribute up to $8,000 to a roth ira. In addition to the general contribution limit that applies to both roth and traditional iras, your roth ira contribution may be limited.

2025 Roth Ira Limits. Not fdic insured • no bank guarantee • may lose value the charles schwab corporation provides a full range of. The roth individual retirement account (roth ira) has a contribution limit, which is $7,000 in 2025—or $8,000 if you are 50 or older.

The maximum amount you can contribute to a roth ira in 2023 is $6,500, or $7,500 if you’re age 50, or older.

Roth IRA vs 401(k) A Side by Side Comparison, Roth ira rules 2023 and 2025: 401 (k) limit increases to $23,000 for 2025, ira limit rises to $7,000, internal revenue service,.

2025 IRS 401k IRA Contribution Limits Darrow Wealth Management, 2025 roth ira income limits. You can contribute up to $7,000 per year to a.